Connecting The $11 Billion Asset Management Market

By David Schnaufer, Qorvo

Tracked your package lately? What about your cargo ship?

Connectivity in the cellular network is booming. We view exponential amounts of wireless information and live on the cusp of not only viewing that data, but using it to create more efficient, safe, and knowledge-based lives. As consumers, we use wireless technologies to monitor our homes, health, children, and pets. Technology provides real-time information, allowing us to view, assess, and react instantly to situations. Businesses also see the benefit of using this ever-flowing data stream — as a way of managing assets, creating efficiencies, and making effective business decisions.

Trains, Ships, And Trucking: The Road To Connectivity

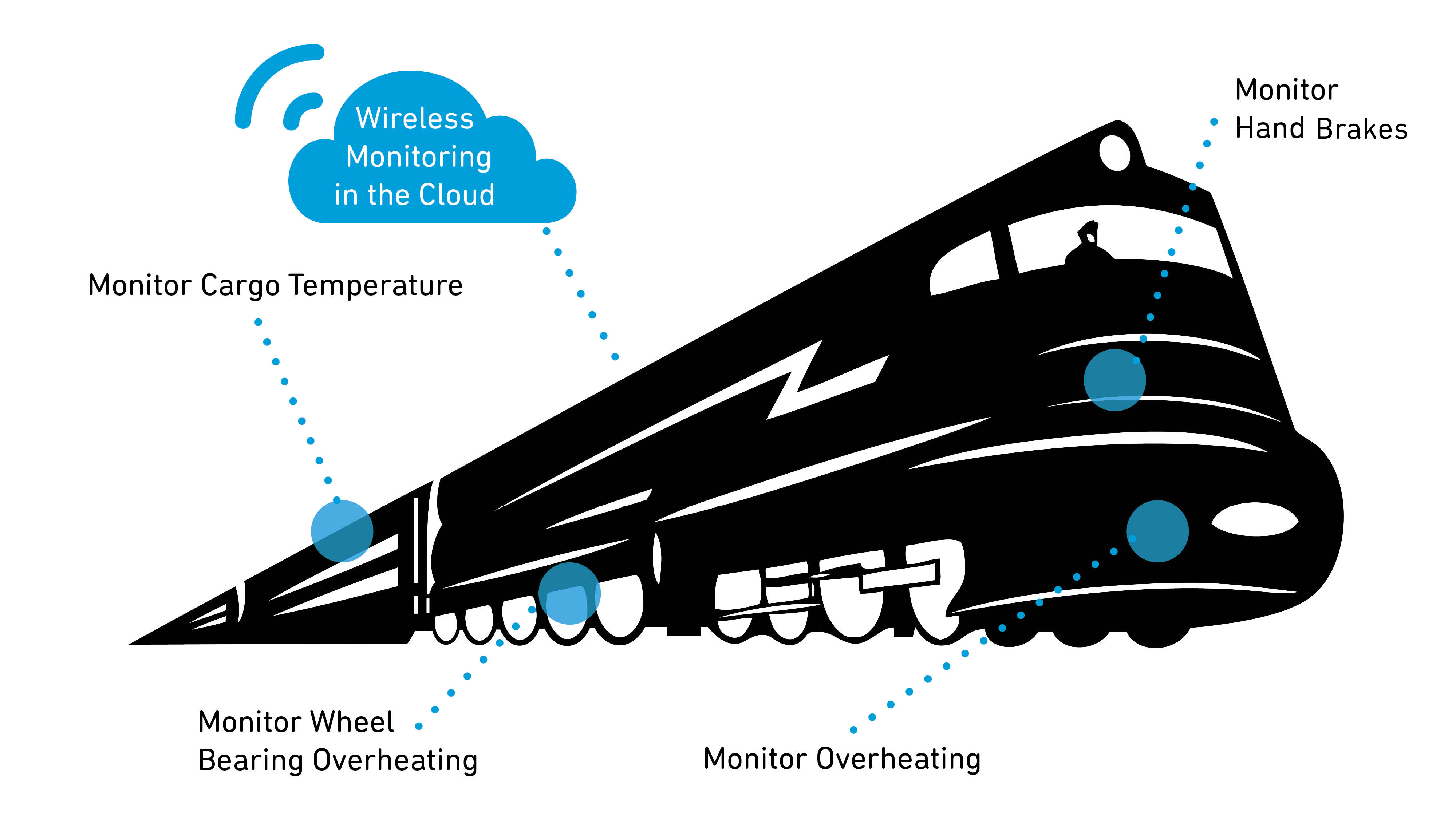

Just as it is important for us to manage our personal assets, organizations have a vested interest in monitoring and maintaining their capital assets. For companies with moveable or remote assets — such as ships, rail cars, and freight trucks — keeping an eye on how their vehicles move and operate is key to maintaining a competitive edge.

Let’s look at some relevant vehicle asset management statistics: There are 1.5 million freight cars in the United States alone, with 22,000 locomotives running over 140,000 miles of track. On the water, there are an estimated 50,000 global merchant ships, scattered across the ocean and internal waterways. Concerning freight trucking, large and small trucking companies must track and monitor their vehicle fleets over 157,000 miles of the U.S. highway system — a large task, indeed.

Clearly, each vehicle management opportunity requires a unique wireless approach. Carrier service providers (CSPs) and machine-to-machine (M2M) manufacturers are creating the network and technology to help these organizations meet their respective transportation management needs.

So, what is the asset (transportation) management market, and who provides the tools and network to service that market?

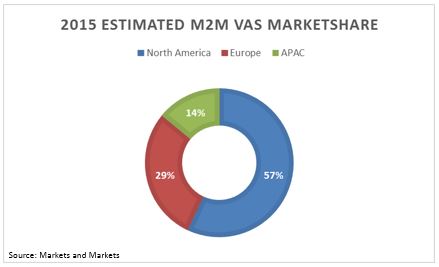

According to Markets and Markets, the cellular M2M market, which includes “applications such as video surveillance, remote diagnostics of vehicles, fleet management, asset tracking, theft recovery, and point-of-sale systems (POS) to provide business efficiency to different enterprises,” is estimated to grow in value from $3.22 billion in 2015 to $11.50 billion by 2020.

North America had the largest market share in 2015, with Asia Pacific (APAC) projected to grow at a high compound annual growth rate (CAGR) from 2015 to 2020. Fleet management includes rail cars, trucks, buses, planes, etc. It includes functions such as vehicle maintenance, tracking, diagnostics, driver management, fuel management, and speed management. It allows companies that rely on transportation in business to minimize — or remove — risk associated with their vehicle investment, which improves productivity, enhances efficiency, and reduces costs.

From a wireless perspective, CSPs and M2M device manufacturers are poised to benefit the most. The CSPs benefit by providing a cellular-based network, targeting M2M services. The M2M device manufacturers benefit by creating products that target M2M cellular, Wi-Fi, and GPS technologies.

Large Scale Connectivity: The Path To The Internet Of Things

This market requires a diverse, large-scale connectivity approach, and CSPs are responding by introducing managed M2M value-added services (VAS). The M2M VAS market comprises a collection of business and technical services managed by cellular carriers; those carriers provide both network connectivity and application platforms.

These value-added services allow carriers and corporate adopters to create, deploy, and manage cellular M2M applications. Major vendors like AT&T, Verizon Communications, China Mobile Ltd., Vodafone, and others are adding these features to their cellular service portfolios. By adding these services to their cellular repertoire of offerings, CSPs also move a step closer to the new market, the Internet of Things (IoT).

In October, Verizon introduced an IoT development platform called ThingSpace, aimed at increasing IoT connectivity by making it easier for developers to build products for the IoT market space. Collaborating with Nokia and Ericsson to integrate its new platform, Verizon is using ThingSpace to help pave a path toward launching a scalable IoT core network.

Other carriers, such as AT&T, in collaboration with companies like Sierra Wireless, have focused their M2M efforts on developing Smart Grid and mHealth solutions. Sprint has focused its effort on connected transportation, connected meters, sensors, alarms and connected machines, while collaborating with companies like Trimble, Prodapt, and U-Blox.

Technologies Used In This Large-Scale Connectivity

Carriers use several technologies to enable today’s M2M VAS, including satellite GPS, geographic information systems (GIS), Wi-Fi, ZigBee, and cellular 4G LTE, all of which are used to provide these managed services.

For example, in-vehicle fleet managed solutions identify and provide information about driving trends and driver behavior, thus reducing the risk of accidents. These cellular platforms also measure dynamic elements, such as driver ID, acceleration, time, distance, speed, shock, and direction changes, which helps to manage labor, fuel cost, and scheduling. The data, sent directly to the cloud using GPS and GIS, allows organizations to track vehicles, provide end-to-end security services - such as managed threat monitoring and vulnerability assessment - and receive real-time, transportation-relevant information. The GPS and GIS systems also help to track and communicate with cargo ships in real-time, thus enabling secured transportation of freight and cargo.

In Summary

The cellular M2M VAS market is poised to dominate the transportation, utility, eHealth, and emerging IoT markets. With a market value estimated to exceed $11 billion by 2020, CSPs and device manufacturers will benefit by deploying tools and services enabling a secure M2M VAS communication network. Qorvo, with its GPS, Wi-Fi, and cellular core RF technologies, already is serving organizations in this market, and we will continue to release next-generation solutions for tomorrow’s 5G M2M VAS market.

- TQP9111 2 stage 2 Watt Tx Linear PA, 1.8 – 2.7GHz

- TQL9093 LNA , 0.6 – 4.2GHZ, 21dB gain, 41.6dBm OIP3

- RFPA5542 5GHz 11ac PA core (Consumer Premise Equipment)

- TQP5525 5GHz 11ac High Power PA (Consumer Premise Equipment)

- RFFM8850P Dual-Band 2.4GHz & 5GHz Wi-Fi Frond End Module

- X-Band GaN RF Transistors In Plastic Packages TGF2977-SM, TGF2978-SM, TGF2979-SM

- Brochure – Qorvo Wi-Fi Filter Solutions

- Brochure – Qorvo Automotive Solutions Product Portfolio

- Brochure – Qorvo Wi-Fi Switch & LNA Front End Solutions

- Brochure – Qorvo Smart Energy Reference Design Portfolio

- Brochure – Qorvo Point-to-Point and VSAT Solutions

- Qorvo’s New Plastic GaN Make X-Band Radar More Affordable