Radar For Automotive: New Market Dynamic For New Players' Positioning

Outline

- Safety regulations and novel driving automation features are driving the radar market.

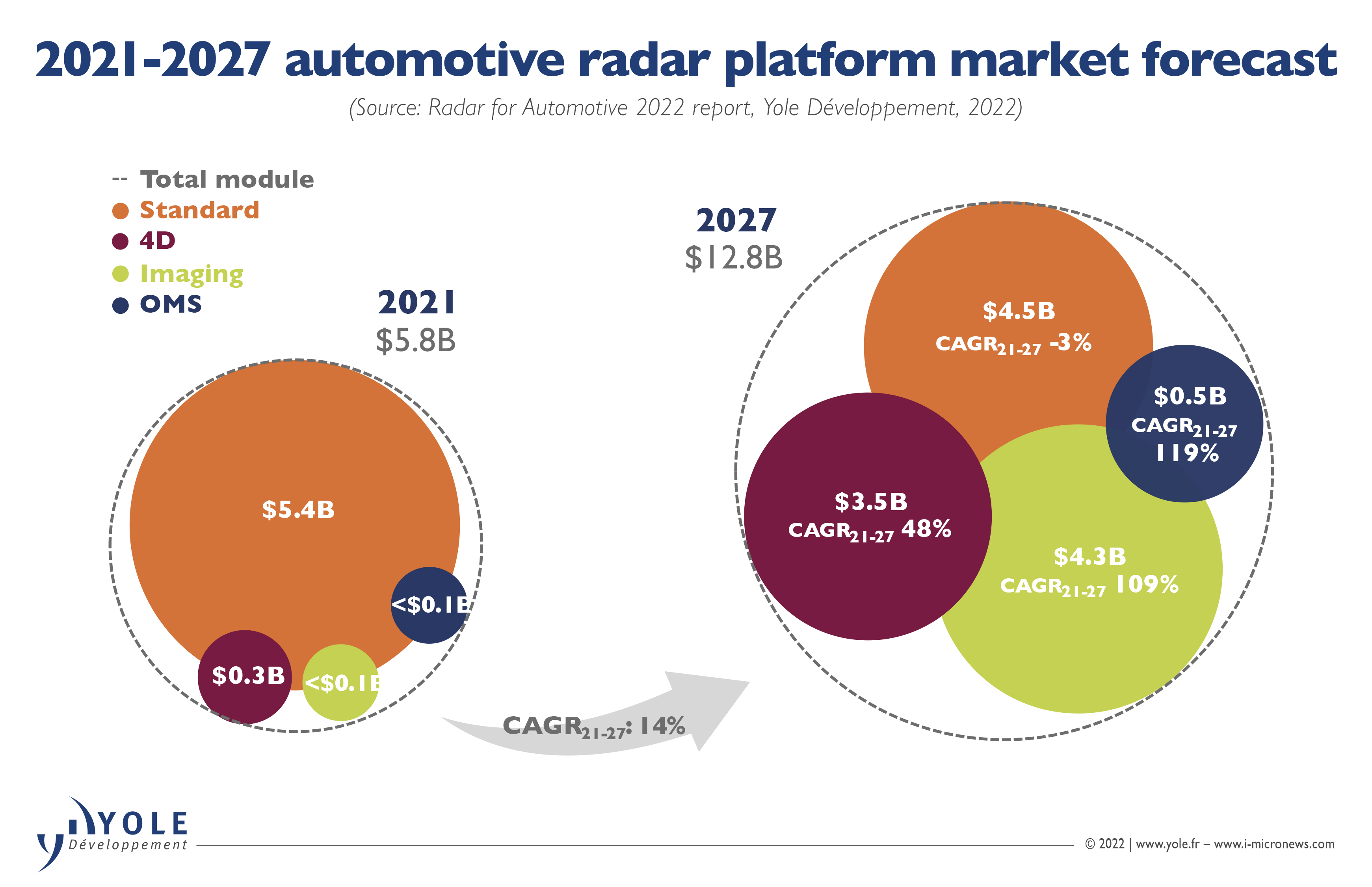

- The radar platform market is expected to reach US$12.8 billion by 2027.

- This market growth will essentially come from 4D and imaging radar…

- A radar module includes multiple ICs1 and/or functionalities: from the radar processor, often an MCU, 2 and the RFIC3, often a transceiver, to the companion PMICs4 and networking chips.

Lyon, France (May 4th, 2022) – Yole Développement (Yole) releases today the Radar for Automotive 2022 report. This technology and market study analyzes the technical challenges and business opportunities. With this new report, the market research and strategy consulting company provides a comprehensive overview of the radar technologies applied to automotive applications, as well as detailed market data. Yole’s analysts deliver a valuable understanding of the value chain, infrastructure, and competitive landscape. This report is one of the comprehensive RF5 electronics collection of products, including technology & market reports, monitors, and dedicated teardowns offered by Yole and its partner System Plus Consulting. The analysis of the technology evolution and strategic choices made by the leading radar companies has been further developed in this new automotive radar report, thanks to the Automotive Radar Comparison report from System Plus Consulting.

Both partners, Yole and System Plus Consulting, have developed a core radar expertise with dedicated technology and reverse engineering experts. All year long, analysts deliver a comprehensive understanding of the RF industry, combining technical insights and market evolution.

Cédric Malaquin, Team Lead Analyst, RF Devices & Technology at Yole, asserts: “The first commercial automotive radar was introduced in 2000 for Daimler and BMW cars. During 2020 and 2021, leading radar suppliers launched their 5th-generation radars. Modern automotive radar sensors inherit from this longstanding evolution cycle. Up to now, the upgrades mainly focused on cost and form factor optimization, which explains the trend towards integration that the industry has pursued.”

Indeed, besides integration, RF performance has dramatically improved over time. Initially, radars operated with analog beamforming and mechanical steering before moving to digital beamforming. In the digital beamforming era, MIMO6 techniques have been introduced, enabling an increase of the virtual antenna aperture while maintaining a reasonable physical size. Currently, MIMO scaling is offered by the industry (from 0.2k to 2k pixels) as the baseline for achieving sub-1° angular resolution for imaging radars. This comes with new challenges needing to be overcome on the signal processing and computing side, which explains why the focus is shifting towards deep learning and artificial intelligence.

The automotive radar market has drawn increasing interest over the past few years. At the system level, the market is led by six major Tier 1s: Continental, Bosch, Hella, Denso, Aptiv, and Veoneer. System Plus Consulting analyzed in detail the technologies and related costs of the main radar systems and their chipsets, including radars from Continental, Bosch, Denso, and others, in its Automotive Radar Comparison 2021 report.

Meanwhile, at the silicon level, NXP and Infineon Technologies share most of the market. Even though the radar market has been well established for many years, Yole’s analysts see many new players positioning and gaining design wins, either at the system level with Magna, Mobis, Weifu, etc., or at the silicon level with Arbe, Uhnder, and Vayyar. And there are more to come, as giant tech companies are also investing in radar development. Therefore, leading companies, including Huawei, Qualcomm, Intel… are deeply involved in this domain. OEMs seeking new revenue sources and eager to differentiate for survival are keen on direct discussions with these companies, shortlisting their traditional suppliers. This is resulting in intense pressure on leading Tier 1s and semiconductor companies that need to innovate faster than their usual time cycle. Therefore, the leading players are seeking synergies either by proceeding to consolidation or moving to vertical integration.

About Yole Group

Founded in 1998, Yole Développement (Yole) has grown to become a group of companies providing marketing, technology and strategy consulting, media and corporate finance services, reverse engineering, and reverse costing services, as well as IP and patent analysis. With a strong focus on emerging applications using silicon and/or micro manufacturing, the Yole Group of Companies has expanded to include more than 80 collaborators worldwide. More